What is the different between a joint life policy and single life insurance policy? Which would be best for your situation? Here’s what you need to know about joint life and single life insurance policies.

This single vs joint life insurance guide will compare joint vs single life insurance policies for couples and help you decide which suits you best.

If you are a married couple or in a long-term relationship, it must have crossed your mind to consider insurance coverage if one of you passes away. As hard as it may seem to grasp, an insurance policy is often the only financial support a family can receive after such a tragic event.

If one or both of you are the breadwinners, paying a mortgage and supporting kids or sick parents, life insurance may be the option that will ensure your stability and financial support.

1. What Is a Single Life Insurance Policy?

As the name implies, a single life insurance policy is meant to cover one person only. In the event of the insured person’s death, a lump sum of money is paid to the beneficiaries.

If a couple opts to have two single life policies, it means that if one dies, the other partner will still have their insurance active.

It’s important to note that both employed and unemployed partners can get a single life insurance policy. You do not have to earn money, so your partner receives the payout. If a working partner passes away, an unemployed partner will have sufficient money to cover living expenses, childcare, and more.

Pros

- Can be combined with joint life insurance, or other alternatives

- Will be valid in the event of separation

Cons

- Can be more expensive

2. What Is Joint Life Insurance?

A joint life insurance policy covers two people in a relationship but pays out only for the first person that dies. Unlike single life insurance, here, two people pay one monthly premium, which also can be more affordable.

Joint life insurance has a ‘first death’ basis. The policy also expires with the first death, leaving a partner without a cover. If you have children who want to ensure financial stability after your death, you must purchase a new insurance cover.

Pros

- Can be combined with individual life insurance or other alternatives

- Can be more affordable

Cons

- The payout is paid only for the first person that dies

- If a couple splits, it may cause inconveniences in payment

- Policy ends when the first person dies.

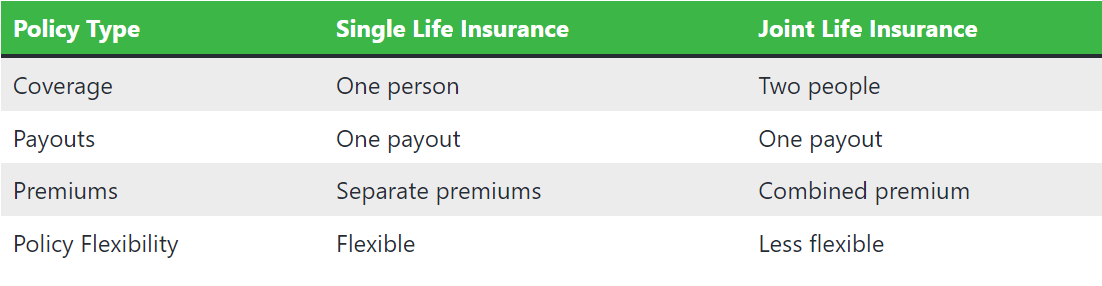

3. Joint vs Single Life Insurance: Comparison

Whichever insurance policy you decide to get, you should learn how they differ and which one is suitable for your family.

The key difference between the two policies is that a joint one pays out and ends with the first death, while an individual cover remains valid until your own death.

The good part is that you can always combine joint with single insurance, although it will be more expensive.

Cost

Since joint life insurance covers two people, it means there is a single monthly premium paid. In contrast, purchasing two individual policies will double that amount.

If your budget allows and you have different financial needs, you can always opt for two insurance covers.

Cover

Although the amount you are willing to pay is a personal preference, the payout differs.

Remember that a joint insurance policy is paid once for the death of one person and expires immediately after. In contrast, a single insurance policy is valid for the same amount of time and pays out for two partners (provided you decide to purchase two single insurance policies).

Yet again, if one of you has children from a previous relationship or a debt, joint life insurance may not be enough to cover all the expenses. You may receive a payout covering the deceased’s debt but insufficient to leave to your heirs.

Payout

The joint life policy payout is the same as an individual one – it is paid once to your beneficiaries. When you take out one of these policies, you will adjust the payout amount, which will also influence your monthly premiums.

If you want a substantial payout, consider a joint family policy, as the premiums will be more affordable than what you might pay for two single policies. Don’t forget that having two single insurance policies will also provide your family with two separate payouts.

4. What Happens to Joint Life Policy After Separation?

What happens after separation often depends on the policy. Your insurance provider might be unable to change the terms you signed up for.

Some providers add a separation clause in the policy that will easily resolve the problem when it arises. If such an option is included, the insurance provider will split your policy into two.

If there is no separation option in your join life insurance, the following will take place:

- One of the partners takes over the policy and continues paying premiums

- Both partners cancel the insurance and purchase a new cover

The latter option is available when both parties sign an agreement to cancel the insurance. The same is applied when handing over the cover to one of the partners. The downside is that the monthly premiums may remain the same.

In case of divorce, you aren’t obliged to inform the policy provider, but if you do, you will learn about your available options.

Another issue you may want to consider after separation is whether to keep your partner as a beneficiary. Although changing may not be possible, you can cancel the insurance. Otherwise, your ex-partner can make a claim in the event of your death.

5. Which Policy Should You Get?

The insurance policy you get will depend on factors such as your budget and needs. If you don’t have big debts or want to be able to pay off a mortgage or shared debts, or want to ensure a stable financial future for your partner and kids, a joint insurance policy should be sufficient.

However, if you have higher expenses and kids from previous relationships or are just afraid your relationship will not last, taking out a single insurance policy may be a better idea.

After all, the final decision is always yours.

However, it’s not a decision you need to make entirely alone. At Insurance Hero, we understand how complicated finding the right insurance policy can be.

That is why we’re here to help. Whenever you find yourself lost in all life insurance-related queries and concerns, feel free to reach out to us. We’ll help you find the best policy and provider tailored to your unique needs.

6. Single vs Joint Life Insurance Conclusion

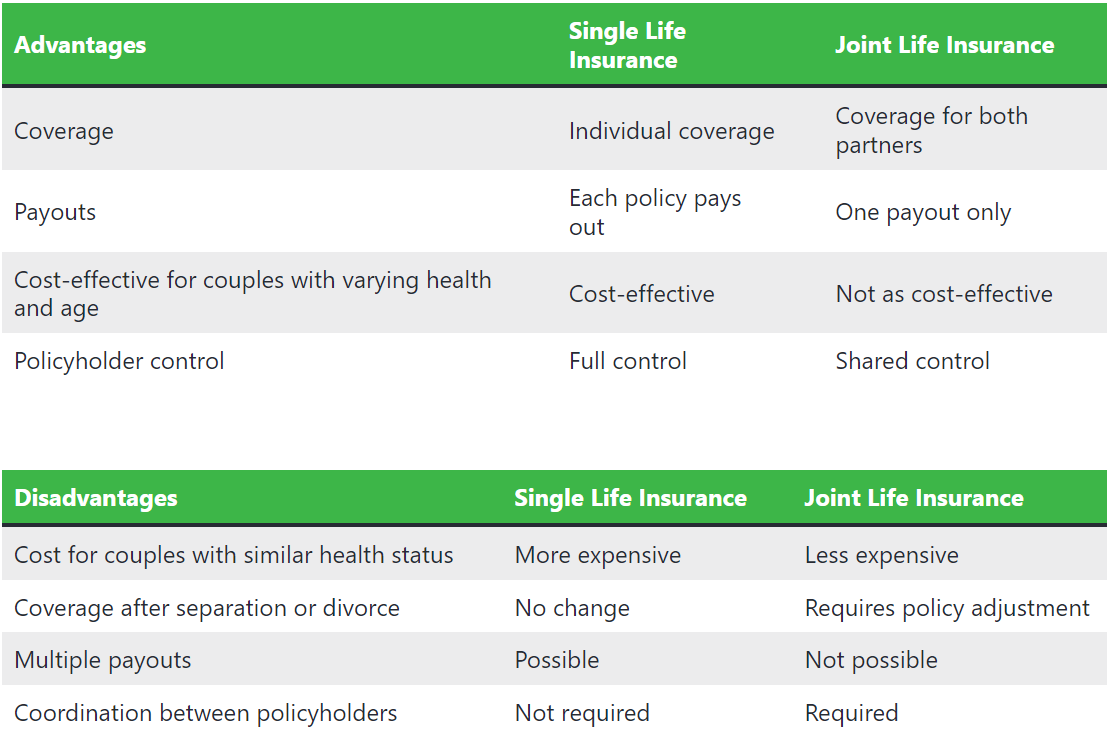

The debate between single and joint life insurance policies in the UK is not one to be taken lightly. As explored throughout this blog post, both options have unique advantages and drawbacks.

Choosing the right one for you and your family ultimately depends on your circumstances, financial goals, and personal preferences.

A single life insurance policy provides flexibility, allowing each partner to tailor coverage to their specific needs and possibly obtain better coverage for a lower premium.

This individual approach also means that if one partner passes away, the surviving partner retains their coverage, ensuring their beneficiaries are protected in the event of their own passing.

On the other hand, a joint life insurance policy often proves to be a more cost-effective choice, especially for couples on a budget. It simplifies the process by consolidating coverage under one policy. In the event of a claim, it can provide financial support for the surviving partner to navigate life after loss.

However, the crucial downside is that joint policies usually pay out only once, leaving the surviving partner without coverage.

The choice between single and joint life insurance policies in the UK is a deeply personal one that should be carefully considered.

It’s important to evaluate your family’s financial needs, future plans, and existing assets to make an informed decision.

Whatever path you choose, the most important thing is to secure peace of mind for yourself and your loved ones. Life is full of unexpected events, and the right life insurance policy can protect your family’s financial future.

Cre: Sara/insurancehero.org